Regulatory and Risk Advisory Solutions

Providing innovative solutions and financial services expertise

allowing our client firms to manage their regulatory and operational risks effectively

MELROSE

Who are we?

What do we do?

Located in Bath, Melrose is a collective of industry experts who collaborate and innovate in the financial services regulatory consultancy space

With a focus on outcome regulation, the financial services industry continues to move away from a prescriptive approach to outcome based regulation. Great for consumers but challenging for firms and practitioners

Melrose pools together extensive knowledge and experience to provide innovative solutions and support helping firms navigate the regulatory and operational landscape

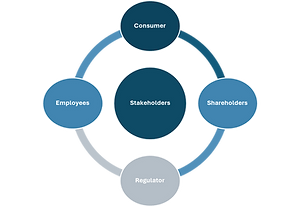

At Melrose we believe optimised results come from a measured approach. There is little point hitting ultimate regulatory compliance & consumer outcomes whilst employees run themselves into the ground and the business fails to be profitable. We look to align consumer, regulatory and business outcomes. Our ethos is to help all stakeholders win, whether it is the consumer, shareholders, employees or of course the regulators. Keep these elements in balance and everyone is happy!

We have developed a range of tools to help our clients make the best of their processes, people and technology to meet the challenging demands of a modern regulated business environment

Whether it is due diligence, consumer duty related activities, remediation, integration, business change or any other regulatory/ operational need, Melrose provides innovative solutions and financial services consultancy, helping clients manage regulatory and operational risks

Brand values

THE FOUNDERS

Why they created Melrose

PEOPLE

VALUE

CLARITY

Having spent their careers supporting businesses varying from one person bands to large plcs, one truth kept shouting out to the Melrose founders: Toxic working environments hamper people’s wellbeing, their creativity and strangle productivity.

The Melrose founders wanted to create a working ethos for their team and clients where productivity and creativity thrives. Promoting collaboration and innovation whilst helping clients create the right culture in their own firms. Look after your people and they will look after your clients and your firm.

Consultancy can be a big business expense. The Melrose team wanted to offer something different to the market. A move away from old fashioned consultancy of chunky prices and solutions that the teams on the ground often find difficult to implement. The team wanted to deliver true value.

The right price, for the right work, at the right time. From the C suite down to the rock face, all areas of the business need to be heard and understood for any outcome to be of value and truly embedded.

Ever attended an event or webinar, or read a set of guidelines and thought "what does that mean to me"? No doubt like the Melrose founders, you have seen many solutions that could leave a practitioner with a confused look on their face. Ivory tower solutions may look pretty but on a practical level they can fail to deliver. Our founders wanted to create solutions that make sense to everyone from the C suite down to the rockface.

Many regulatory consultants haven't worked in the businesses they are advising. The Melrose team believe that understanding what it is like for the people actually operating in the controlled environment is crucial to delivering a practical and workable solution.

The Melrose founders wanted to be able to provide solutions that not only makes sense, but will truly make a difference, improving operational efficiency, culture and outcomes for all involved.

Some of the challenges Melrose look to help firms address

THE BURDEN OF REGULATION

Operating within a controlled environment, financial service firms will always carry the burden of regulation. However it does not necessarily follow that this needs to be a crippling one!

Regulation, approached with the right mindset and solutions can give great outcomes for the business, employees, consumers and the regulator

At Melrose we look to balance the requirements of a firm’s stakeholders and ensure pragmatic yet innovative solutions that can be embedded effectively and make a difference

BEING CUSTOMER CENTRIC AND PROFITABLE

We aim to help firms get the right balance between positive outcomes for the business and their consumers. We do this by ensuring we all understand what success looks like then helping our client firms gain measurable operational and regulatory efficiency

Regulation is complex, so you won't hear us telling you that we are here to make it simple. We are here to help make regulation part of sound business practice, looking after the consumer as well as profitability

THE MOVE FROM PRESCRIPTIVE TO OUTCOME REGULATION

A financial advisory firm wouldn’t deliver a one size fits all financial solution to all their consumers, and neither would Melrose

Our team have worked with many different types of firms giving us front row seats to understanding what does and does not work

We seek to understand what our client firms are trying to achieve before applying our experience to provide innovative workable, practical solutions

Effective outcome regulation needs a workable strategy to give practitioners workable processes and structure

LACK OF RESOURCE AND COST OF SUPPORT

Whether short on time resource, expertise or perhaps you just need a second opinion, Melrose can help

Unlike many consultants, our team has had operational experience within a wide array of firms, from one-person bands to plcs. We seek to understand a firm's unique requirements before providing expertise and resource as required

Acknowledging cost and value as not the same thing, we avoid change for changes sake and aim to give true value for money

The Melrose Scale

Regulatory work is often subjective and based on interpretation. The Melrose Scale distils large amounts of regulatory & operational data. It brings clarity by providing qualitative and quantitative assessment via a set of impactful diagrams. Easy to interpret, they grade a firm’s current position across 125 regulatory and operational aspects. It highlights areas of excellence as well as areas in need of improvement, helping firms deliver great outcomes to the business’s four stakeholders.

Ideal for

Merger and acquisitions

Regulatory and operational due diligence

Integration planning

Selling a firm

Creating information memorandums to assist sale of firm and to support negotiations

Self assessment

Identifying and evidencing regulatory and operational capability

Growth planning

Identifying regulatory and operational improvements to achieve most effective impact

Easy to interpret

Multi-use

-

125 assessment criteria points distils operational & regulatory data into a set of easy-to-read diagrams

-

Easy to interpret, regardless of reader’s regulatory and operational knowledge

-

Melrose scale diagrams are ideal for use in a multidisciplined merger and acquisition team

-

Demonstrates potential outcomes for consumers should an acquisition/integration proceed

-

Can be used to compare one prospective target firm against another, helping merger and acquisition teams in their decision making process

-

Providing qualitative and quantitative data which helps support negotiations

-

Can be used to compare prospective merging firms to identify efficient integration pathway

-

Logic mapping assists with integration and improving efficiency

Value

-

Sensible pricing based on size of firm and underlying activity

-

Evidences firm’s operational and regulatory capability

-

Identifies operational and regulatory areas to improve

-

Provides mapping for future growth and improvement

Contact us for further information and logo/photo files